On Election Eve, Here's The Economic Outlook

Published Friday, October 30, 2020, 8:00 p.m. EST

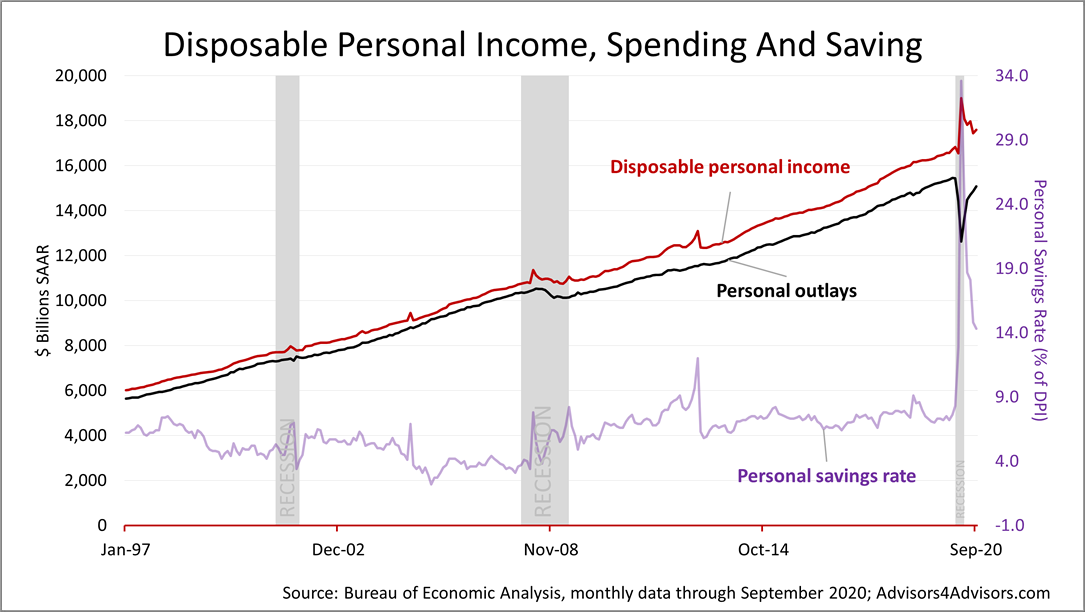

U.S households in September were still saving at twice the "normal" rate pre-pandemic, according to an analysis of data released today by the U.S. Bureau of Economic Analysis.

The 14.1% reading in September was down from the history-making 33.6% savings-rate spike in April, which was fueled by federal coronavirus emergency aid payments enacted under the CARES Act.

Another federal aid package may not come until January, depending on Tuesday's election results. However, the 14.1% savings rate indicates consumers are sitting on a considerable cash cushion.

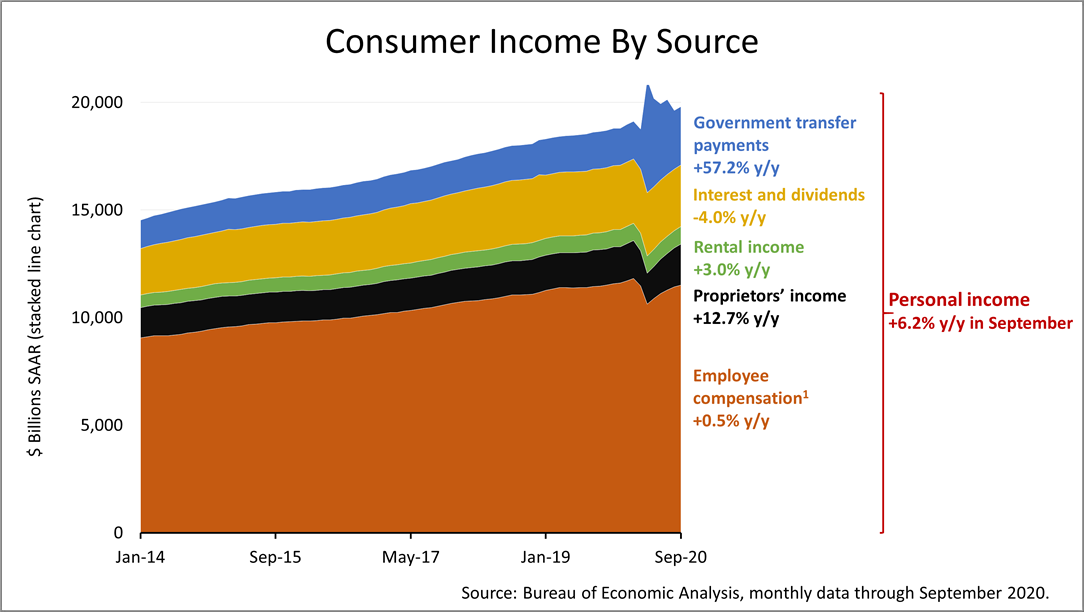

Consumer income rose 6.2% from October 1, 2019 to September 30, 2020, despite the coronavirus. How could that have happened?

It's largely because of the government emergency aid payments. Government transfers accounted for 9% of total consumer income in January to 14% in September. In addition, proprietors' income surged by 12.7% from a year earlier in September.

Keep in mind, the most important component of consumer income, employee compensation, accounted for a smaller share of total consumer income, and the government transfer payments add to the long-term debt of the United States.

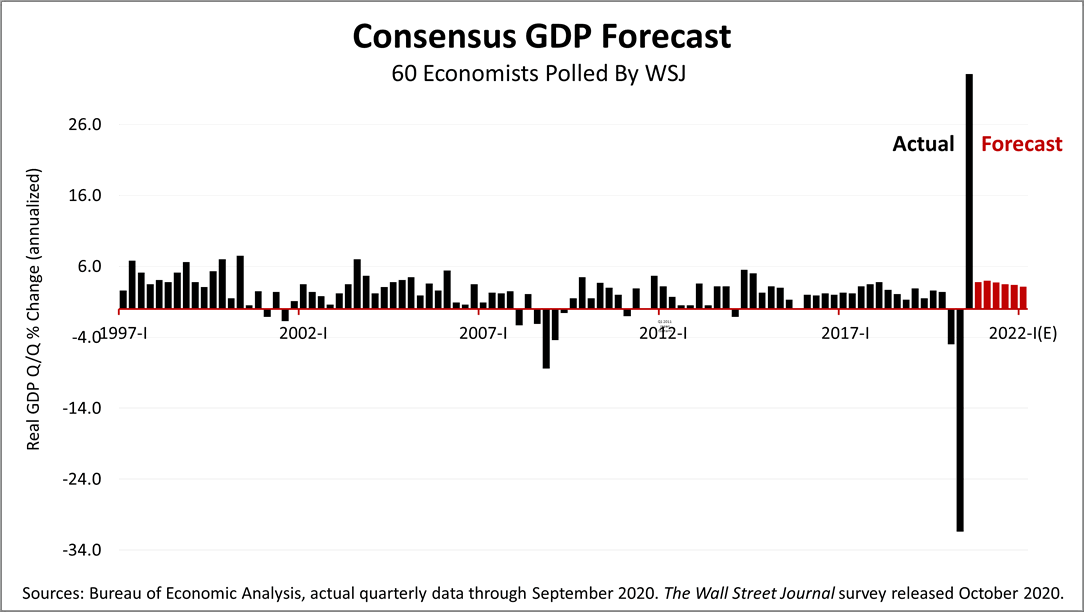

Earlier in the week, BEA released its first accounting of growth in the third quarter of 2020, reporting the U.S. grew by 33.1% on an annualized basis. A 33.1% growth rate is unprecedented in modern U.S. history.

After the outbreak in March, economists initially predicting a 20% spike in gross domestic product. The 33.1% spike was literally off the charts before Covid. It is further evidence of a V shaped recovery

The 60 economists surveyed in mid-October is also shown in this chart in red, and this shows the shape recovery over the six quarters ahead.

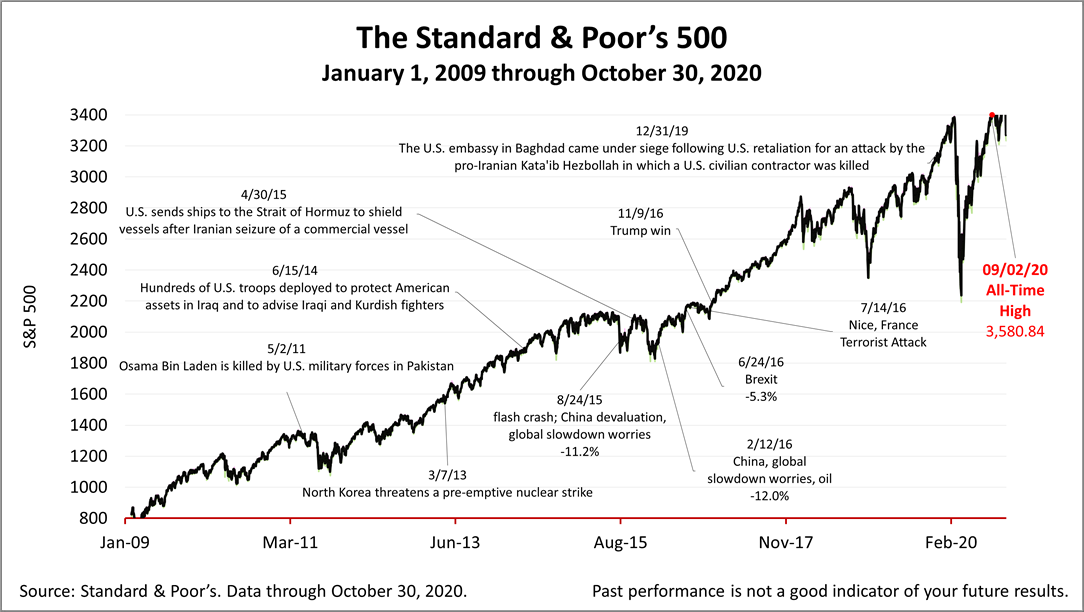

The Standard & Poor's 500 stock index closed Friday at 3,269.96, loss of -1.21% from Thursday, and down a whopping -5.8% from a week ago. The index closed +37.49% higher that its March 23rd coronavirus bear market low. It was the worst weekly decline in the index since March. Stock prices have swung wildly since the coronavirus crisis started in March and volatility is to be expected in the months ahead.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial or tax situation, or particular needs. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. The material represents an assessment of financial, economic and tax law at a specific point in time and is not a guarantee of future results.