A Prudent Perspective On Recent Volatility

Published Friday, August 16, 2019 at: 7:00 AM EDT

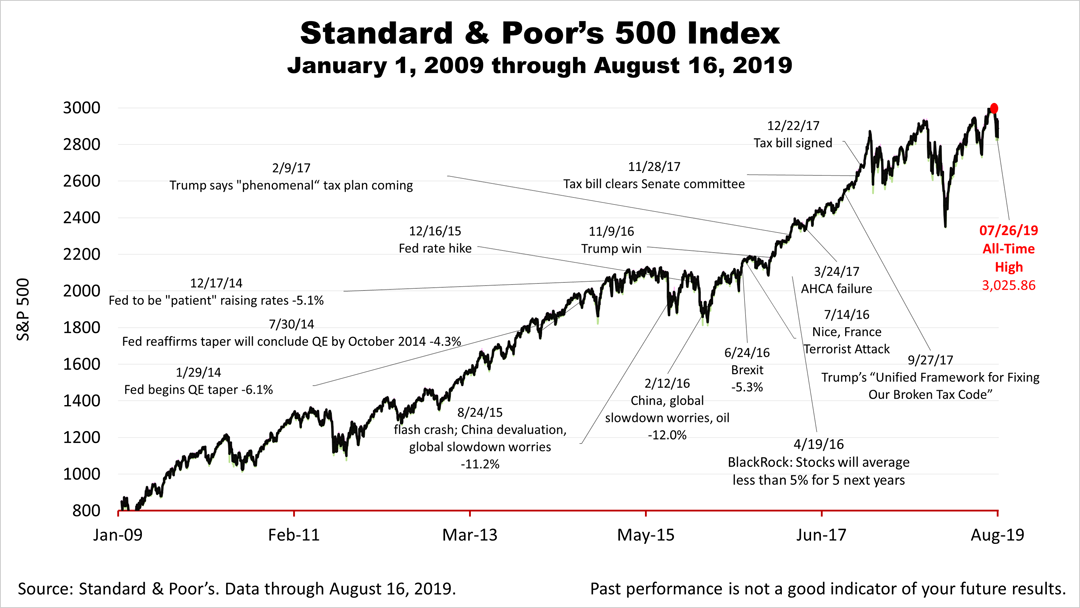

Fears of a recession caused a 2.9% price plunge on Wednesday but the Standard & Poor's 500 index rebounded sharply by Friday on news of strong retail sales in July and closed the week at 2888.68, less than 5% from its all-time high.

Retail sales — excluding gasoline because of their volatility — surged 3.7% in the 12 months through July, following its 3.8% spike in June and 3.1% rise in May.

Since 70% of U.S. economic activity comes from consumers, the continued strength in retail sales dampened fears of a recession.

You can't have a recession if consumers are spending like this!

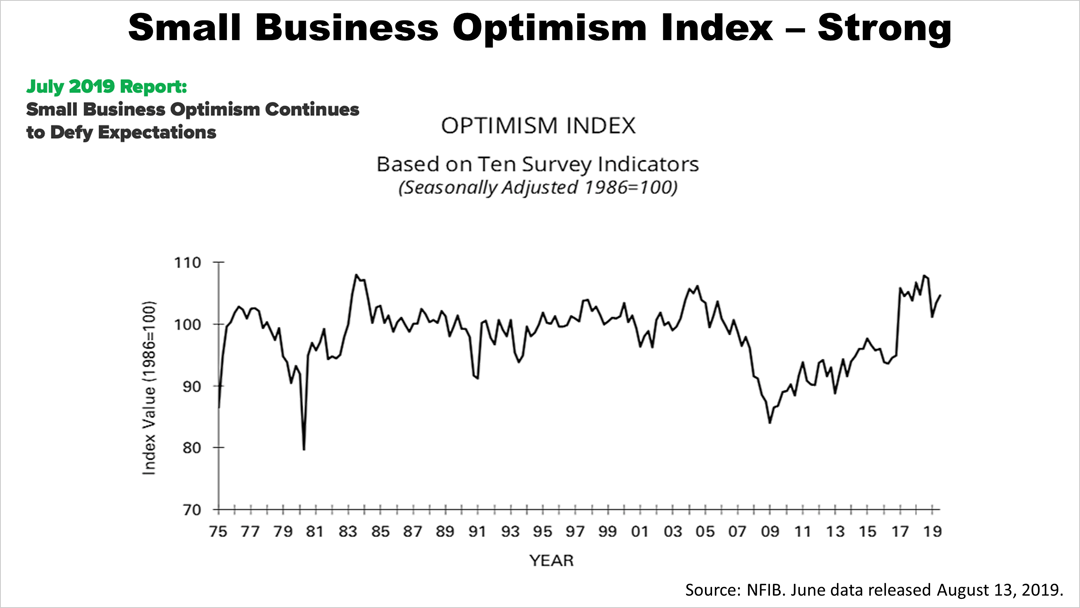

Meanwhile, the National Federation of Independent Businesses' index measuring small-business owner optimism, released on August 13th, remained near its 44-year high.

Small business generates about 60% of new jobs. With business owners so optimistic, a recession is unlikely.

Recession fears and market volatility are widely attributed in the press to the inversion of the yield curve. But the news reports are not written from the perspective of a prudent financial professional.

On Wednesday, the three-month Treasury-bill yielded more than a 10-year Treasury bond. In the past, when short-term yields are higher than long-term yields, when investors are not rewarded for taking the risk of owning long-term bonds, it's signaled the onset of a recession.

However, it may be different this time. The yield curve inversion on Wednesday may not be a reliable indicator in current economic conditions. While the yield curve has been a fairly reliable signal of a recession in the past, this time the U.S. yield curve is influenced by an unprecedented condition: negative yields in Europe and Japan.

Negative yields in Europe and Japan are depressing yields on long-term U.S. bonds, causing the inversion in U.S. yields. The inversion makes it prudent for investors to expect lower returns on fixed-income portfolio allocations in the years ahead, but it does not mean the U.S. is headed for a recession.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial or tax advice without consulting a professional about your personal situation. Tax laws are subject to change. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. No one can predict the future of the stock market or any investment, and past performance is never a guarantee of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

.png)