Wall Street Reacts To D.C With A 7% Weekly Gain

Published Friday, November 6, 2020, 8:30 p.m. EST

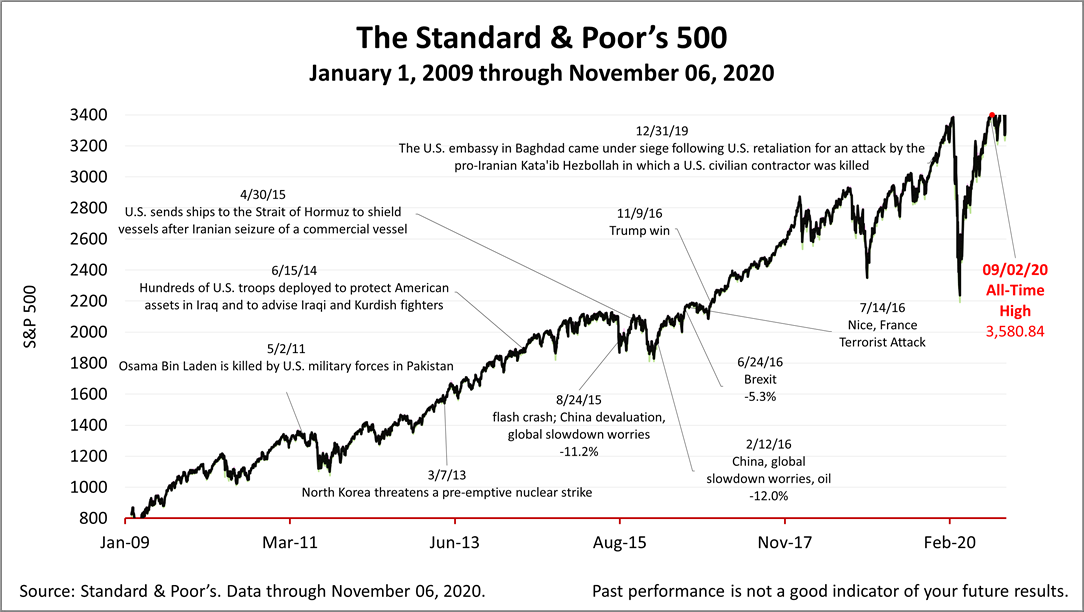

Despite the high-stakes of the election results, Wall Street reacted to news out of Washington by gaining 7% for the week. The Standard & Poor's 500 closed lower by a fraction today, after rack up five straight days of gains amid the swirl of political news, as economic bright spots appeared.

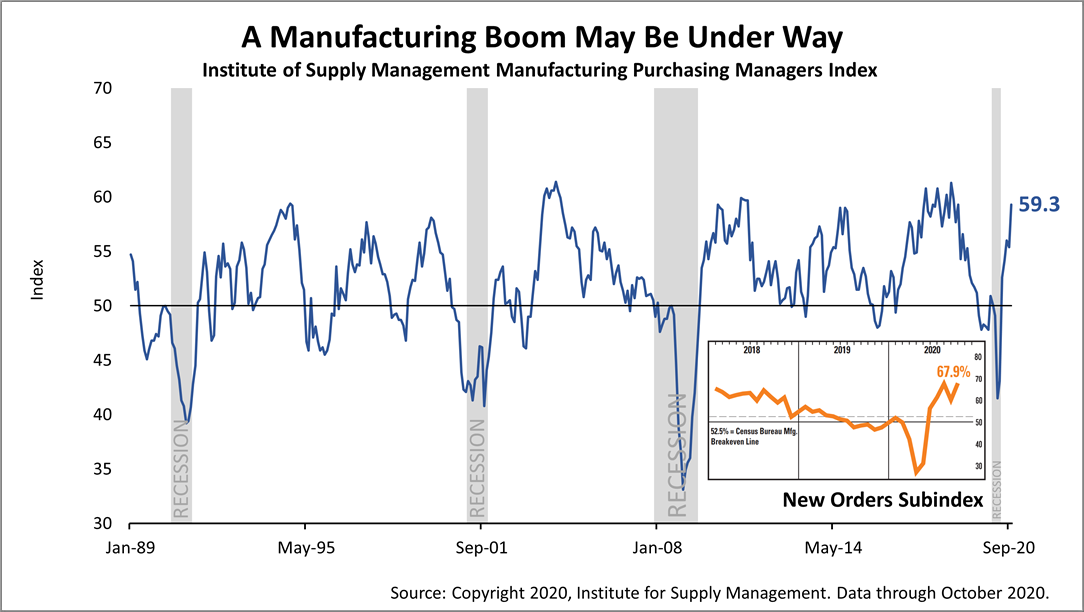

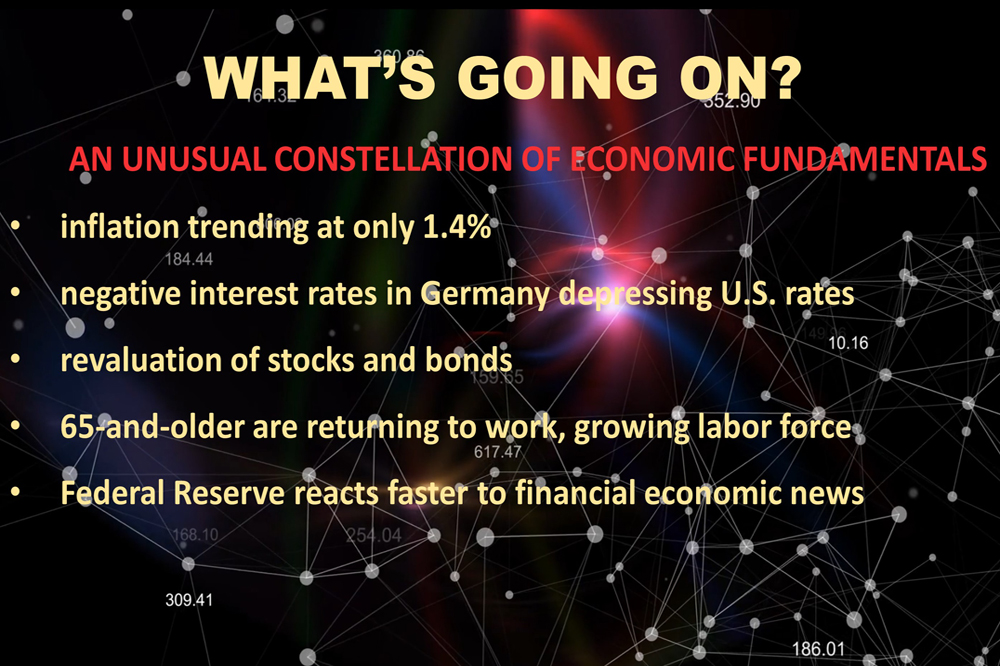

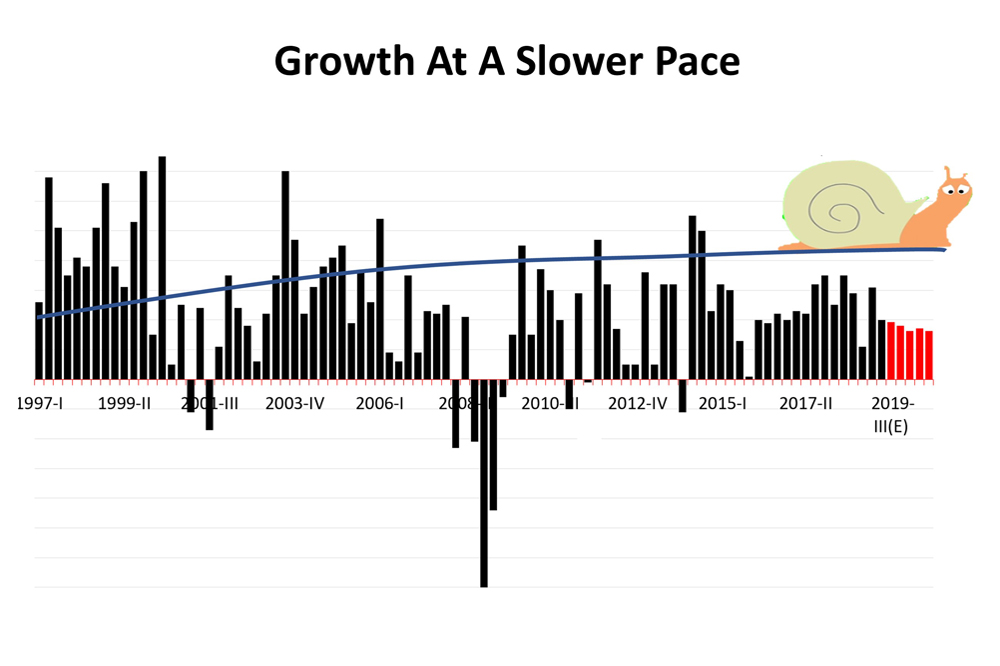

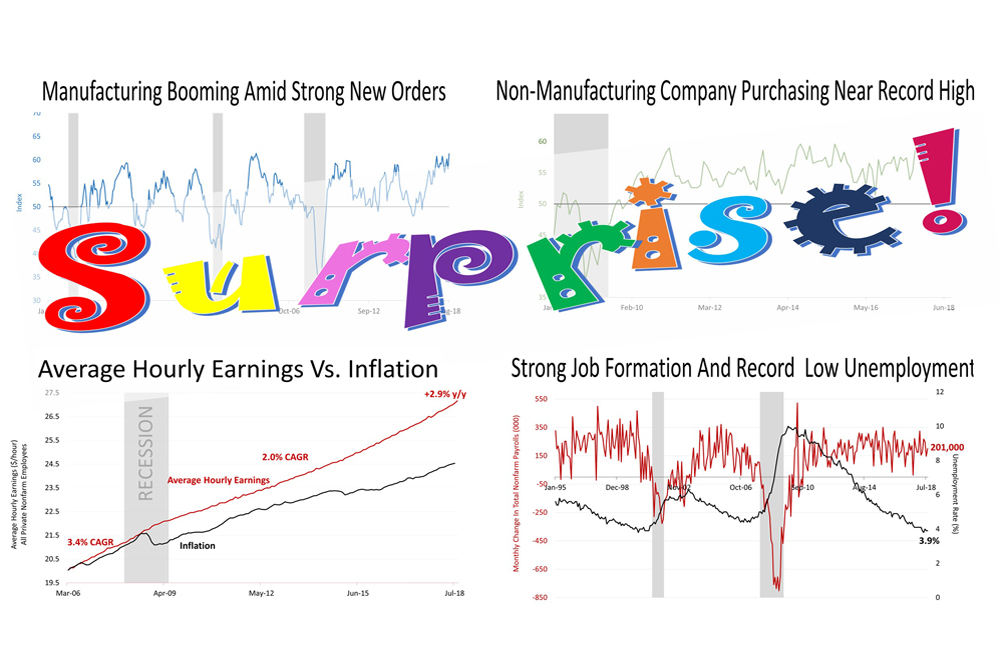

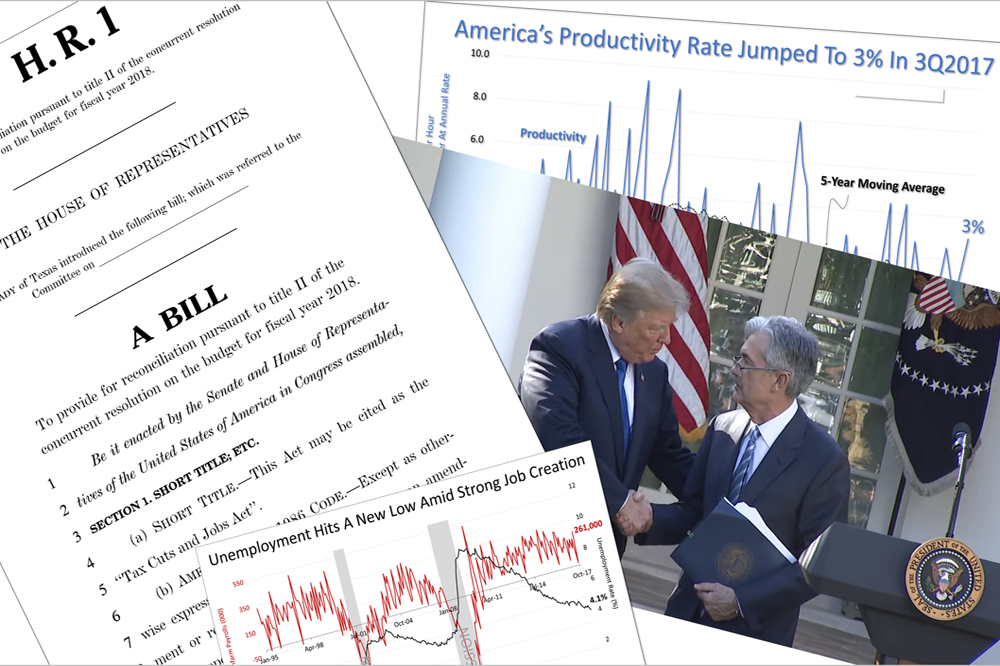

A boom in manufacturing may be underway. At 59.3, the manufacturing purchasing manager index is strong relative to the past 30-years. In addition, a forward-looking subcomponent of the index that measures new orders hit 67.9, indicates the next few months could be extremely strong as the new orders come through the pipeline in the weeks ahead.

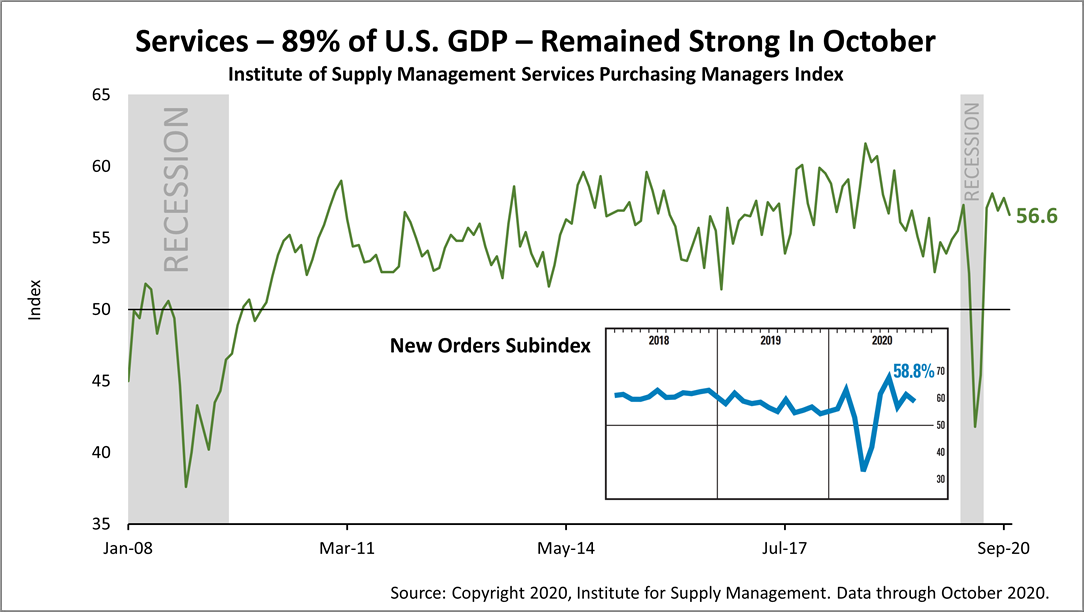

Moreover, the more important services segment of the economy, which accounts for 89% of economic activity, stayed strong in October.

According to the newly released survey report by ISM, the 56.6 reading was 1.2 percentage points lower than a month ago. However, service industry activity is coming off an unprecedented surge in June. The level of new orders at service companies dipped in October from a month earlier, but remained high relative to recent history, which includes the 2019 peak in the size of the economy.

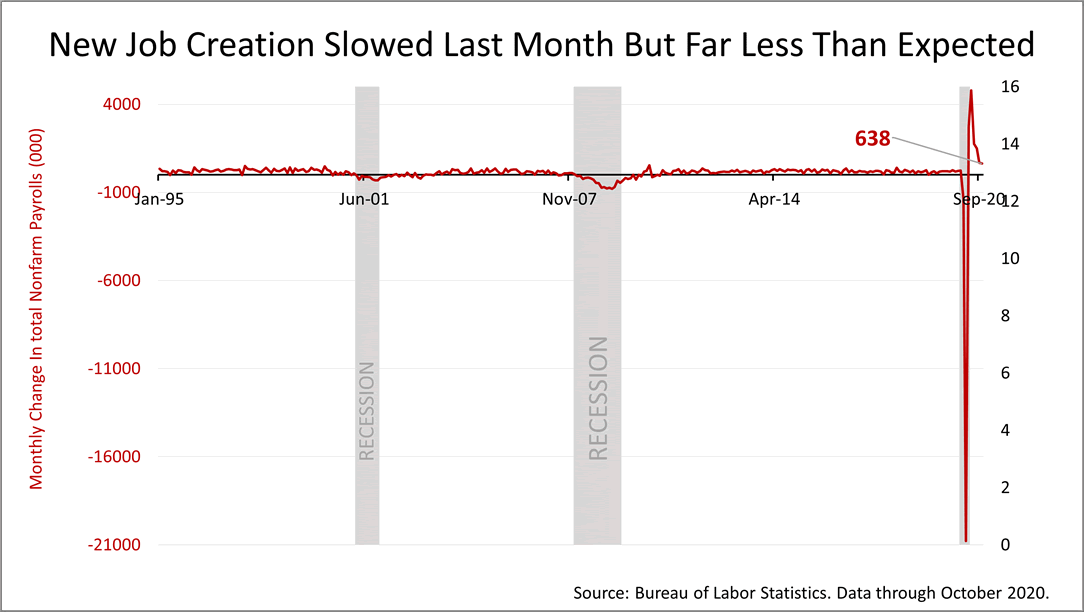

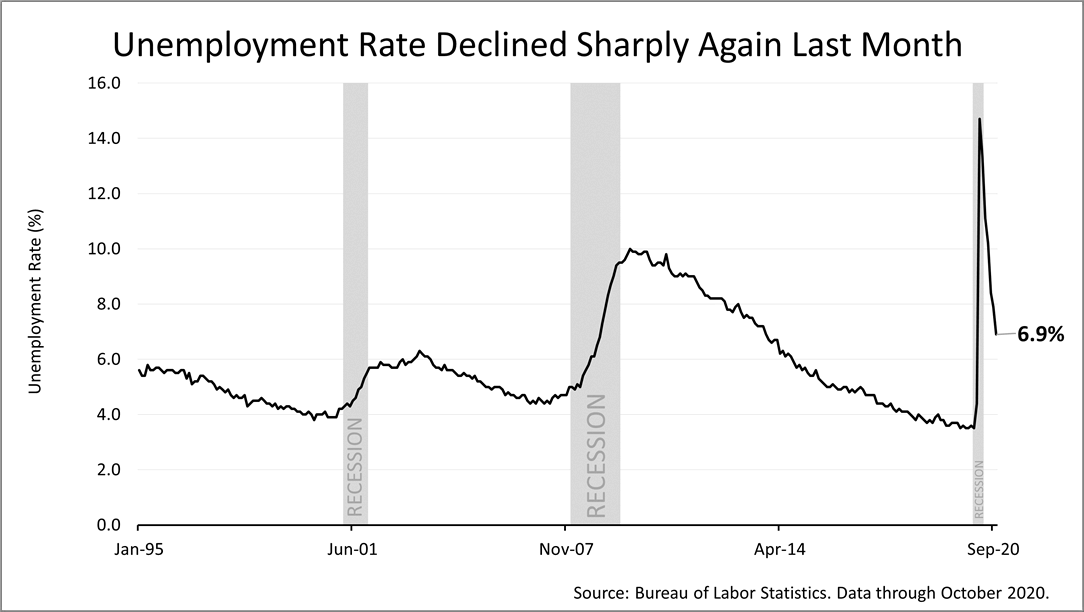

The U.S. Bureau of Labor Statistics this morning said there were 638,000 more new jobs created in October than were lost.

That's down from 672,000 in September, but nonetheless far better than the 530,000 net new jobs that were expected.

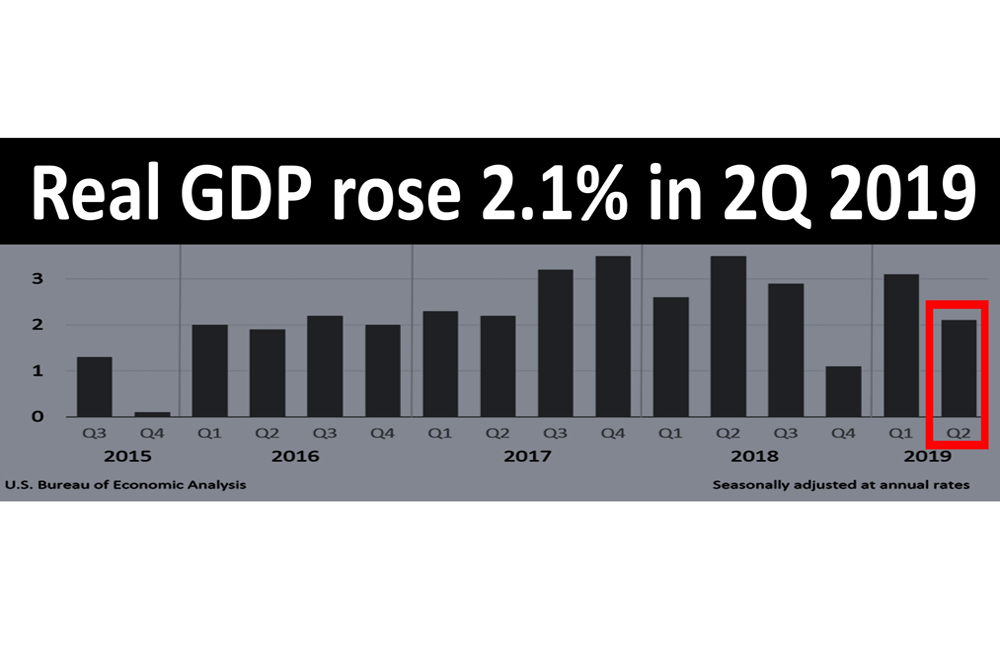

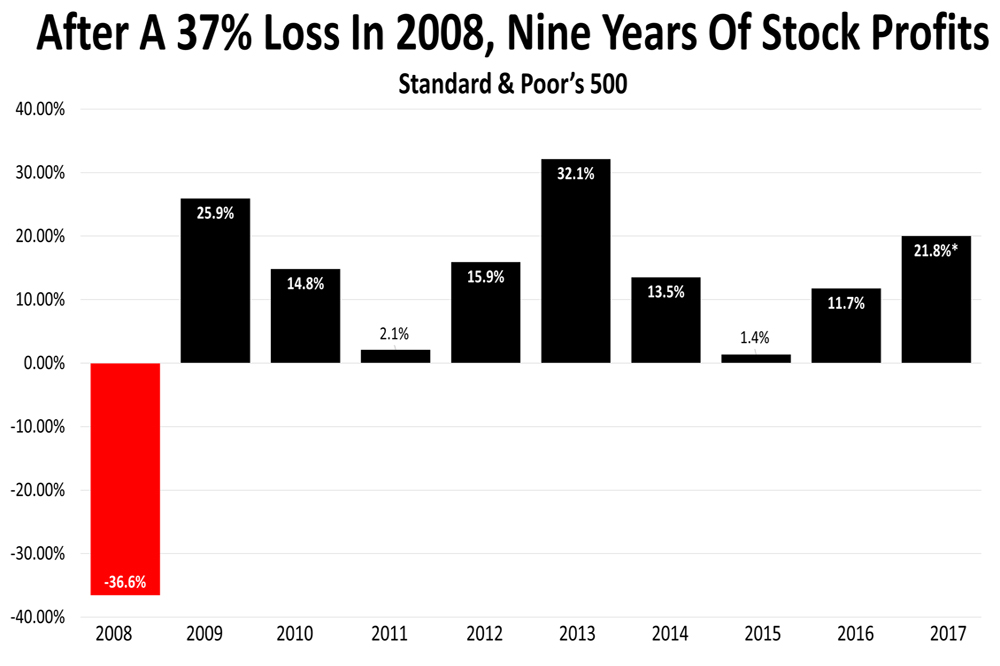

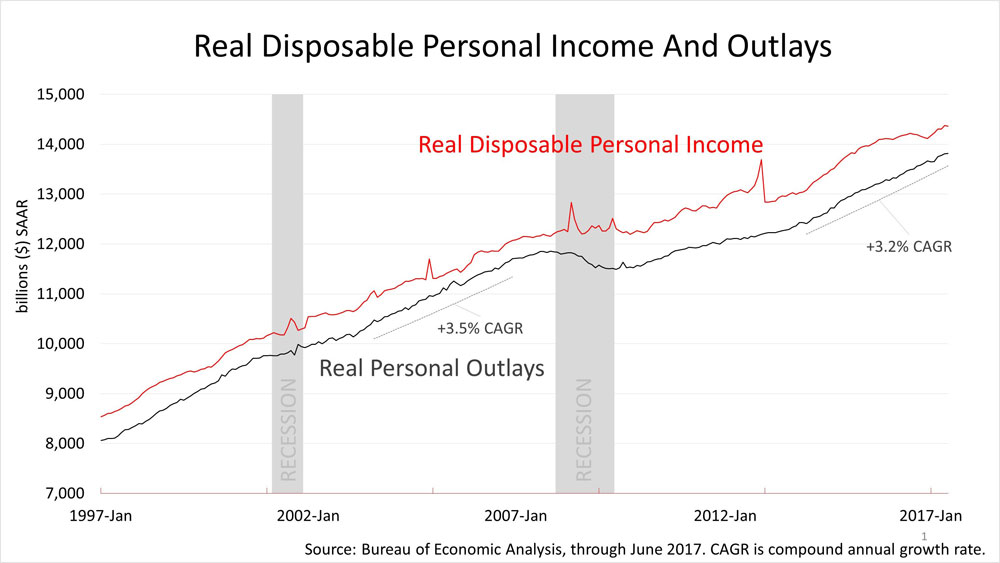

The unemployment rate declined a full percentage point in October to 6.9%. Compared to recovery from The Great Recession of 2008, the unemployment rate is about half-way back. Considering that the economy did not suffer a severe setback but was shut down, the recovery from the Covid pandemic peak in unemployment could be faster than usually expected after a recession.

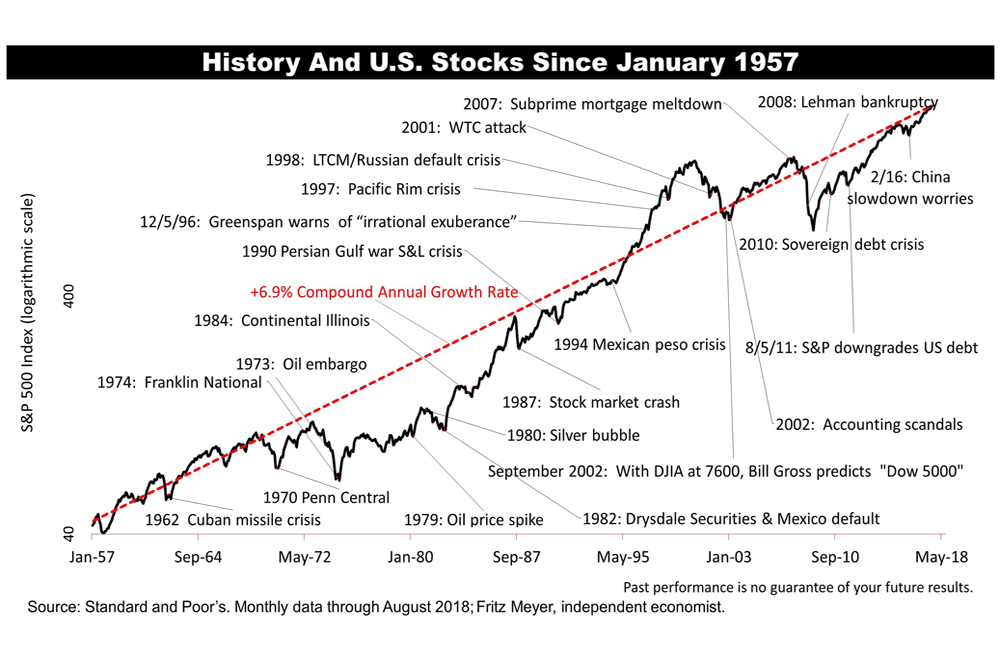

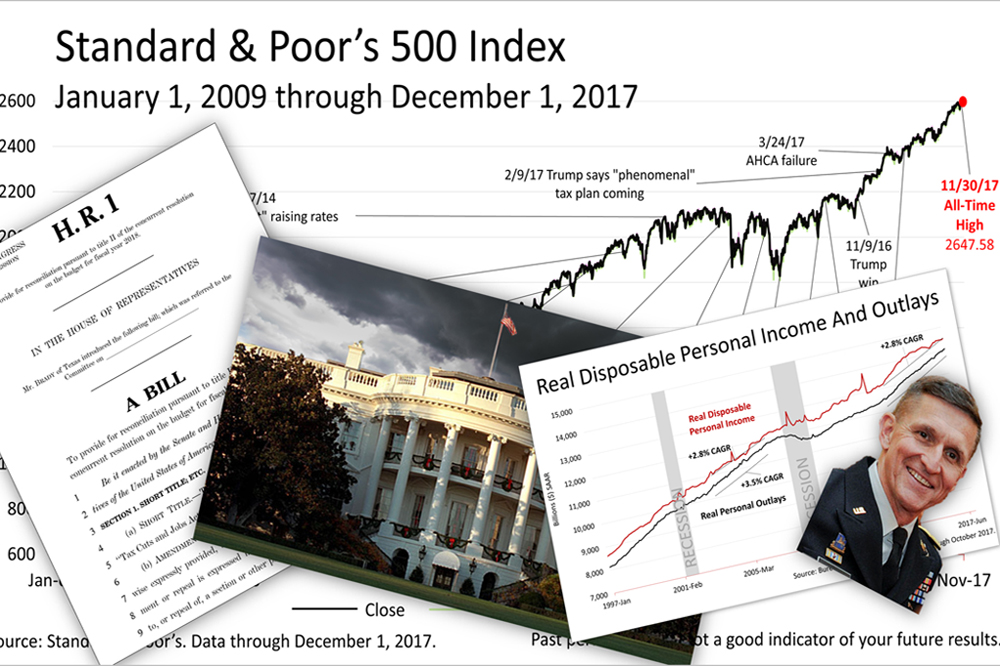

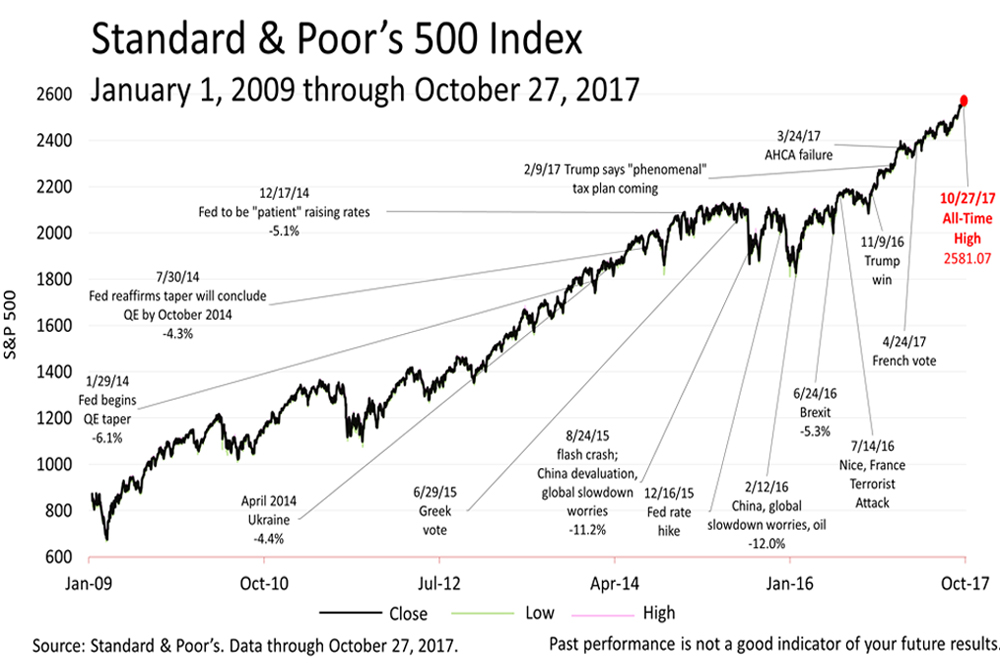

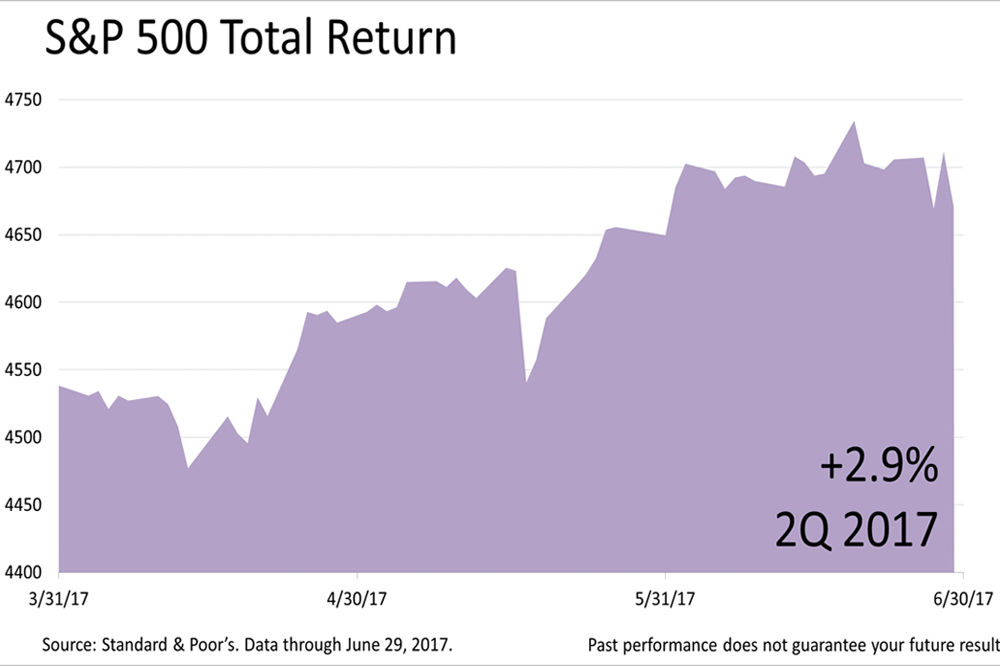

The Standard & Poor's 500 stock index closed Friday at 3,509.44, down 0.03% from Thursday, up +7.06% from a week ago, and +44.26% higher than its March 23rd bear market low.

The S&P 500 had its best week since April.

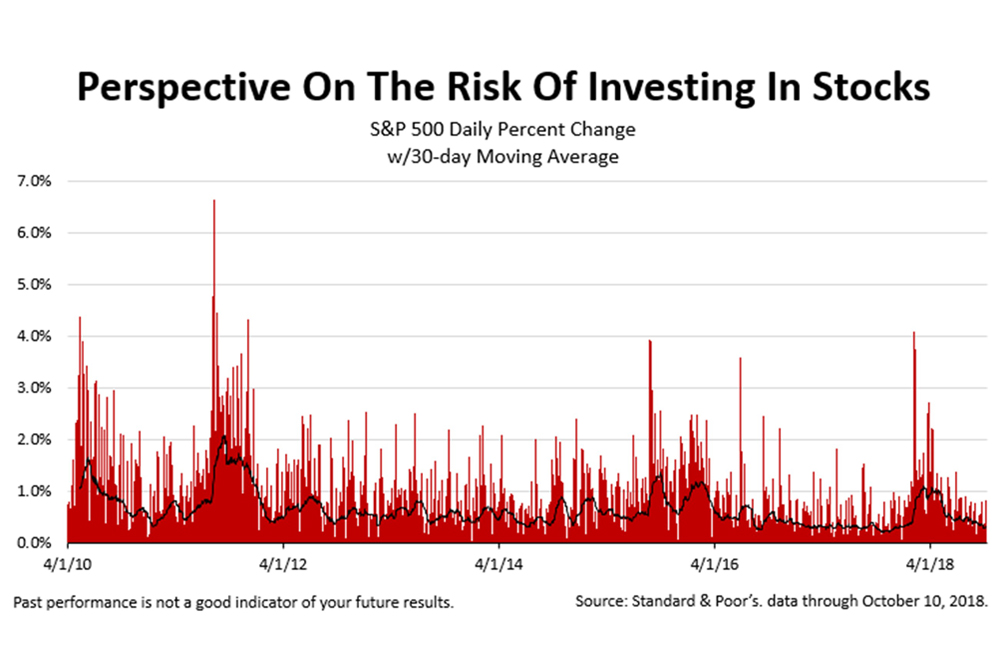

Stock prices have swung wildly since the coronavirus crisis started in March and volatility is to be expected in the months ahead.

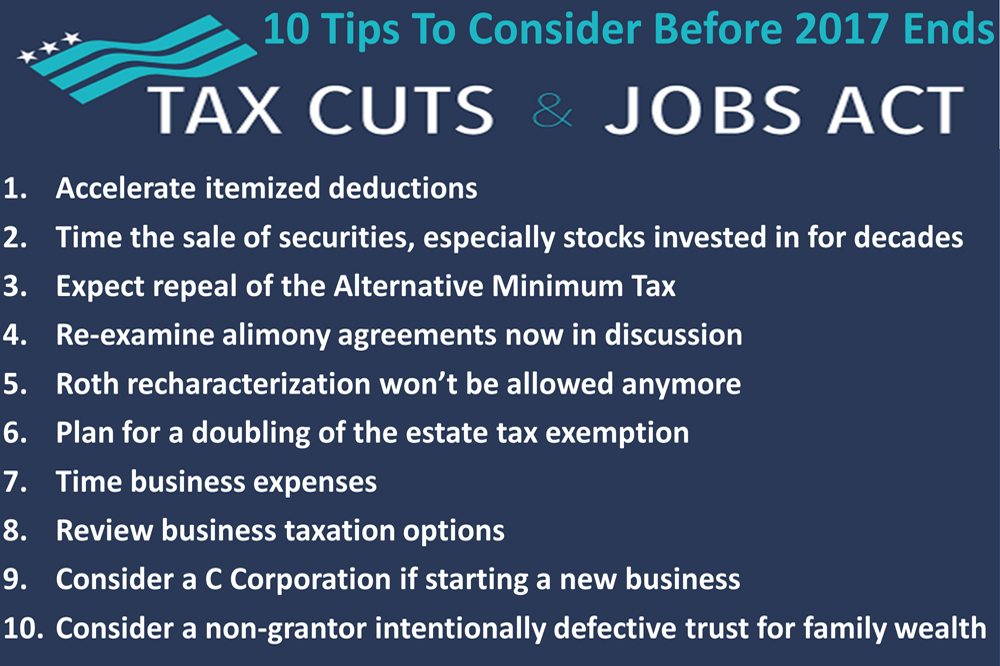

With Joseph R. Biden widely expected to become the next President, tax hikes are more likely. However, with a slimmer majority of Democrats in the House of Representatives and control of the Senate not expected to be decided until after runoff elections in Georgia on January 6, 2021, income and estate tax planning require urgent attention for retirees, pre-retirees, individuals with more than $400,000 of income, and those with an estate of $3.5 million or more.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial or tax situation, or particular needs. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. The material represents an assessment of financial, economic and tax law at a specific point in time and is not a guarantee of future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

.png)