Despite Gloomy Jobs Report, The Economic Outlook Remains Bright

Published Friday, October 8, 2021 at: 6:48 PM EDT

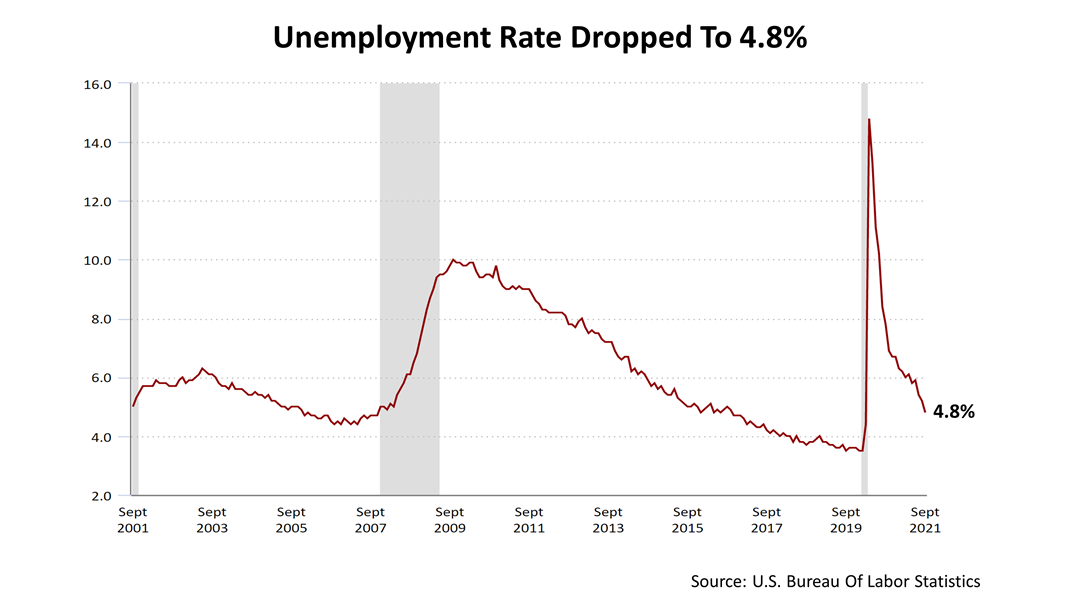

The rate of unemployment fell by four-tenths of 1% in September, the U.S. Bureau of Labor Statistics reported Friday, but only 194,000 new jobs were created, far less than the 500,000 expected.

The employment situation report highlighted shifting economic crosscurrents causing turbulence in financial markets. While a lower unemployment rate is, of course, a positive sign – 710,000 people found jobs -- the labor participation rate was stayed at 61.6% in September, 1.7 percentage points lower than before the pandemic hit the nation. That means the supply of U.S. workers is still smaller than before the Covid outbreak in February 2020. A smaller labor force makes for a smaller economy, inhibiting U.S. growth.

However, the normally reliable statistics measuring fundamental economic factors are filled with aberrations caused by the pandemic, making the data harder to read "Much of the disappointment in payroll growth came from strange statistical quirks around school reopening," economic columnist Neil Irwin at The New York Times wrote after analyzing the September figures were released Friday morning. "The number of jobs in state/local education combined with private education fell by 180,000 in September — when the customary seasonal adjustments are applied. There is reason to think the pandemic made those seasonal adjustments misleading"

The investment markets were volatile this week. The labor market is one of numerous clouds shrouding the U.S. economic outlook. Higher than expected inflation, the Federal government debt ceiling, high price-to-earnings ratios versus the historical norm, much-higher energy prices, and shifting crosscurrents are clouding the outlook.

However, economists expect a pickup in fourth quarter growth of U..S. gross domestic product as the Delta variant’s drag on third quarter growth becomes less influential in the fourth quarter, as Covid cases have peaked. With strong personal income, consumer spending, housing starts, and the U.S. Index of Leading Economic Indicators at a record high, economic fundamentals have remained very positive. Meanwhile, cash in consumer accounts available for spending remains astounding.

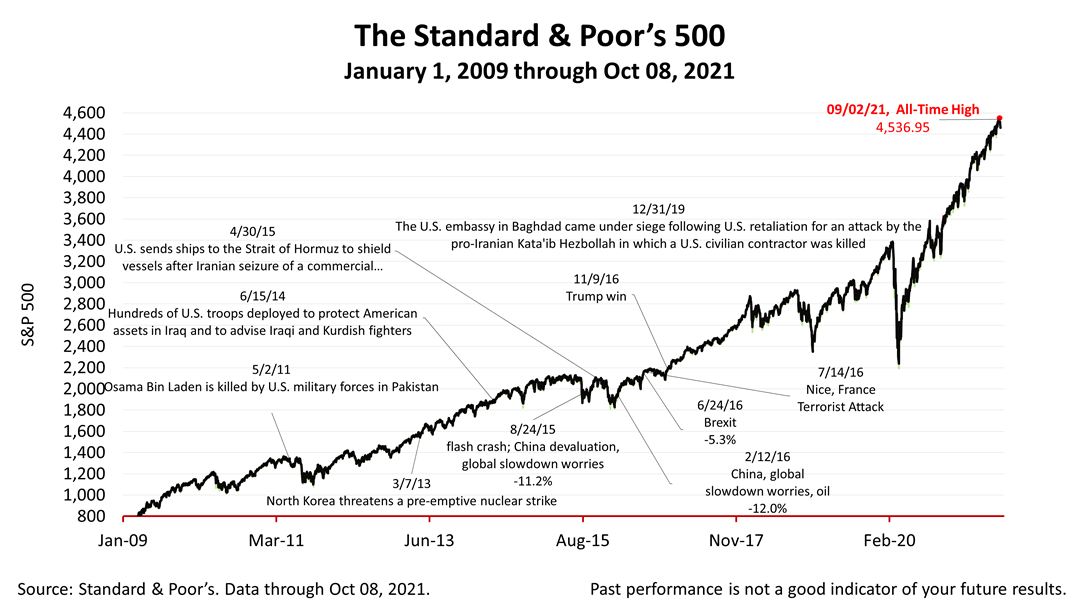

The Standard & Poor’s 500 stock index closed this Friday at 4,391.34. The index lost -0.19% from Thursday and was down +0.78% from last week. The index is about 5% lower than its all-time closing high on September 2 and up +64.98% from the March 23, 2020, bear market low.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

.png)