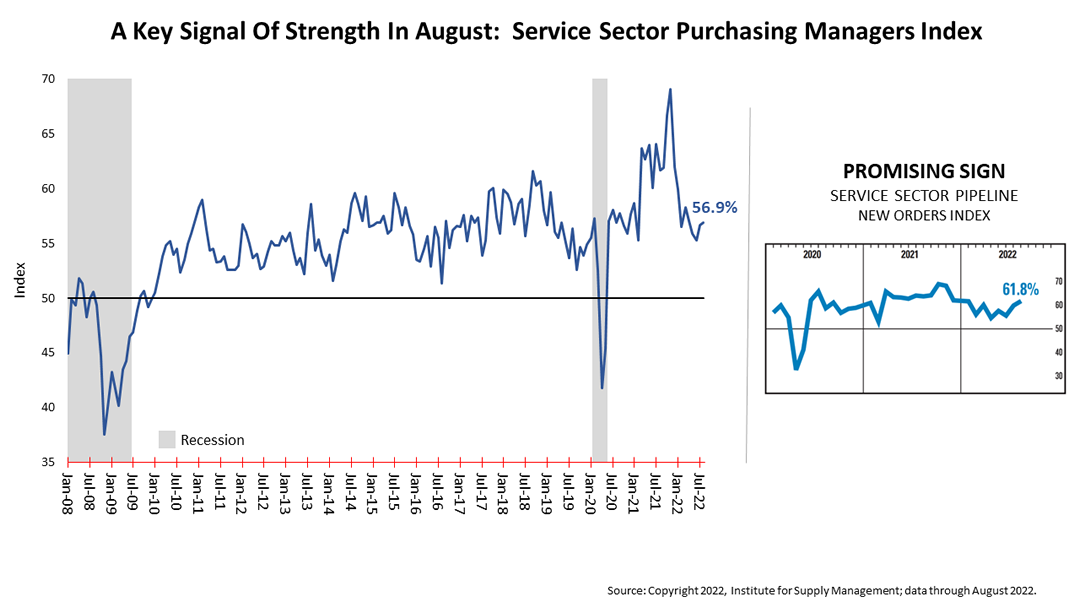

A Key Signal Of Strength At A Pivotal Moment In Economic History

Published Friday, September 9, 2022 at: 6:57 PM EDT

It is a pivotal moment in economic history. The dust is settling from the economic shock caused by the Covid-19 pandemic. Meanwhile, the post-pandemic inflation crisis and Russia-Ukraine War linger on, creating stock market uncertainty, fueling fears of an economic downturn, and, in some quarters, of a worldwide financial disaster. So, the latest data on the service sector of the U.S. economy is indeed reassuring.

Amid considerable gloom and doom, the index of business activity in the service sector, which accounts for 89% of U.S. gross domestic product, ticked up in August to 56.9%. No collapse is under way. Far from it, the pace of business activity in the service sector is in line with the rate averaged in the last expansion, the 11-year boom that began in April 2009 and ended when Covid hit in February 2020.

In addition, the new orders index, a forward-looking sub-component of the purchasing managers index maintained by Institute of Supply Management (ISM), an association for purchasing management professionals, came in at 61.8%.

A private-sector institution that conducts the surveys of purchasing managers monthly, ISM began publishing the service sector index in 2008. It’s constructed using the same methodology as ISM’s index of the manufacturing sector, which has been published for many decades and is a valuable metric of current activity in the manufacturing economy. ISM says a reading of more than 50% indicates that the services sector economy is generally expanding; below 50% indicates that it is generally contracting.

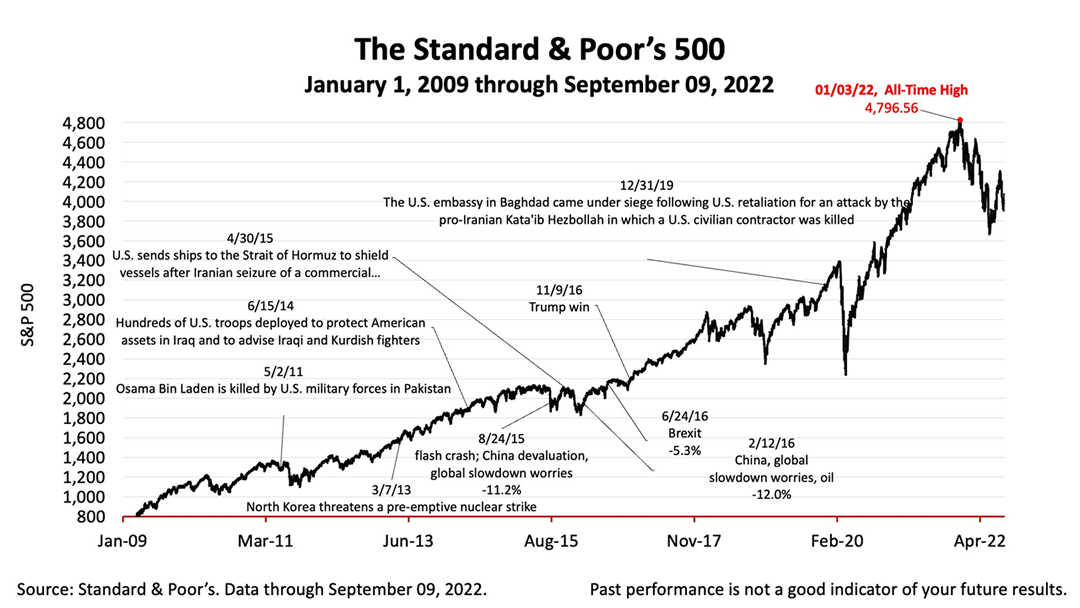

The Standard & Poor’s 500 stock index closed Friday, September 9, 2022, at 4,067.36. The index gained +1.53% from Thursday and +3.58% from last week. The index is up +58.05% from the March 23, 2020, bear market low and down 16.45% from the January 3rd all-time high.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

.png)